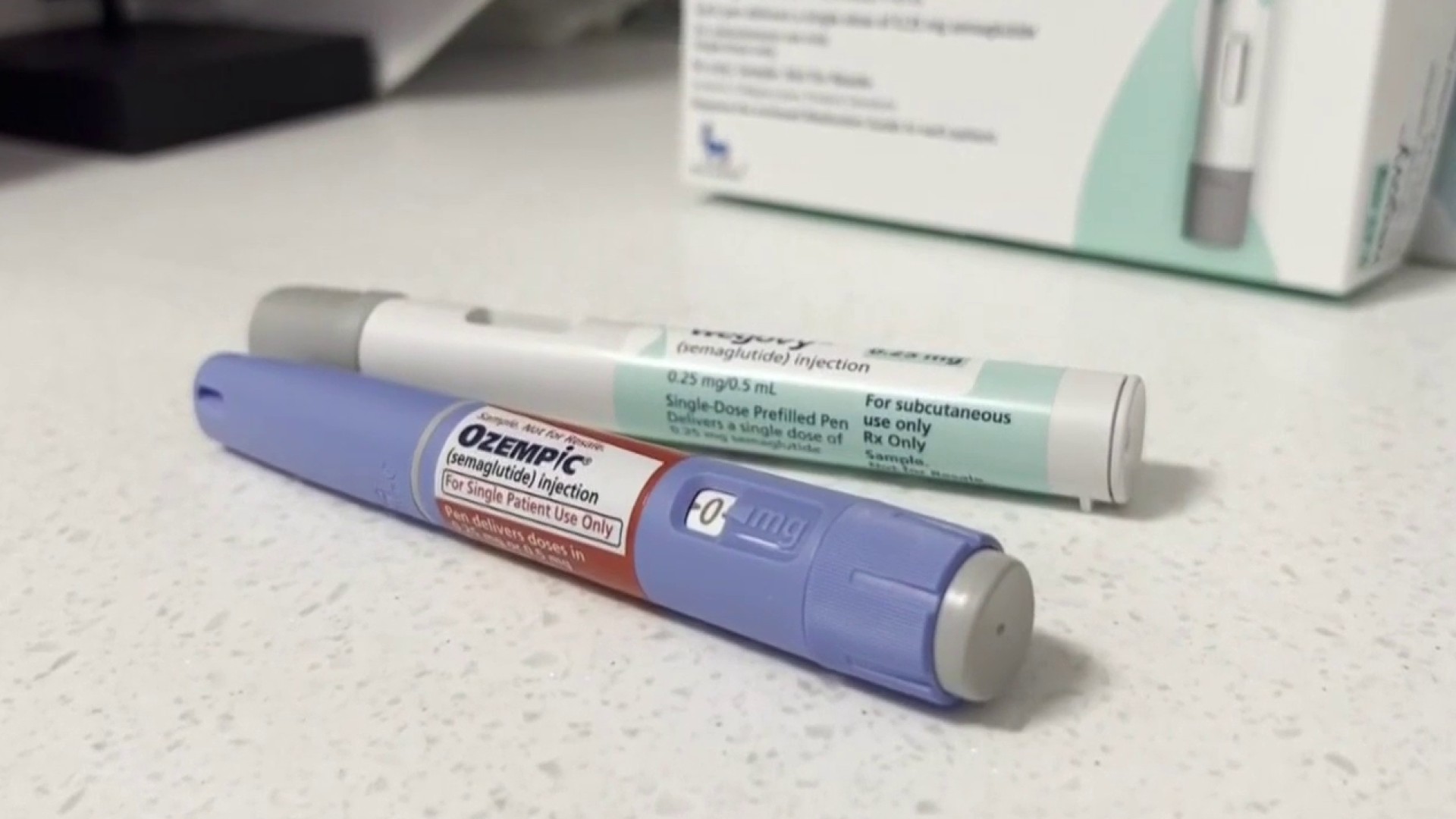

The recent rise of alternative weight-loss drugs faces a significant challenge as the FDA has issued warnings against companies trying to evade regulatory standards. This development comes in the wake of decreasing shortages of popular GLP-1 medications, such as Novo Nordisk’s Ozempic and Wegovy, as well as Eli Lilly’s Zepbound and Mounjaro.

Many firms are attempting to exploit a loophole that permits the sale of compounded versions of these medications. The FDA’s actions indicate a tightening of oversight as the market begins to stabilize.

The FDA announced that it has officially removed tirzepatide injections, including Mounjaro and Zepbound, from its Drug Shortage List. The agency stressed that compounded drugs must comply with specific conditions to qualify for exemptions that allow them to be marketed. This designation of shortage has been in place since 2022, underscoring the disruptions in the supply chain for GLP-1 medications and the challenges faced by patients seeking treatment.

Following the FDA’s warning, the Alliance for Pharmacy Compounding urged pharmacies to stop preparing and dispensing compounded versions of Mounjaro and Zepbound. Eli Lilly supported this directive, calling for an end to the mass production of compounded and counterfeit tirzepatide. Analysts have interpreted the FDA’s warning as a clear indication that regulatory scrutiny will be increasing, especially now that traditional supply chains are becoming more reliable and the shortage is easing.

The immediate repercussions of the FDA’s warning were evident in the market, particularly for telehealth platforms like Hims & Hers, which experienced a notable drop in stock prices.

Although Hims does not offer compounded tirzepatide, it provides a compounded version of semaglutide, a key ingredient in Novo Nordisk’s Wegovy, which is still in short supply. This regulatory shift raises concerns for patients who have been relying on compounded GLP-1 medications, as many will find their prescriptions suddenly unfillable and will need to consult their healthcare providers for new prescriptions.

As regulatory scrutiny increases, states are facing challenges in overseeing compounding pharmacies. The FDA has issued consumer warnings, and major pharmaceutical companies, including Eli Lilly and Novo Nordisk, are actively pursuing legal actions to protect their market share.

A recent study revealed that nearly half of the online pharmacies selling anti-obesity drugs were doing so without proper state licenses, complicating the regulatory environment further. As traditional GLP-1 drugmakers reclaim their market dominance, significant changes are on the horizon for weight-loss medication accessibility and regulation.