Pfizer CEO Albert Bourla announced on Monday that the pharmaceutical giant’s $43 billion acquisition of Seagen will enable the company to scale up delivery of Seagen’s cancer therapy worldwide in unprecedented ways.

“We can add value to what Seagen is bringing,” Bourla stated in interview. “It’s more or less a situation like when mRNA was in our hands. With our scale, with our capabilities, this is the same here.”

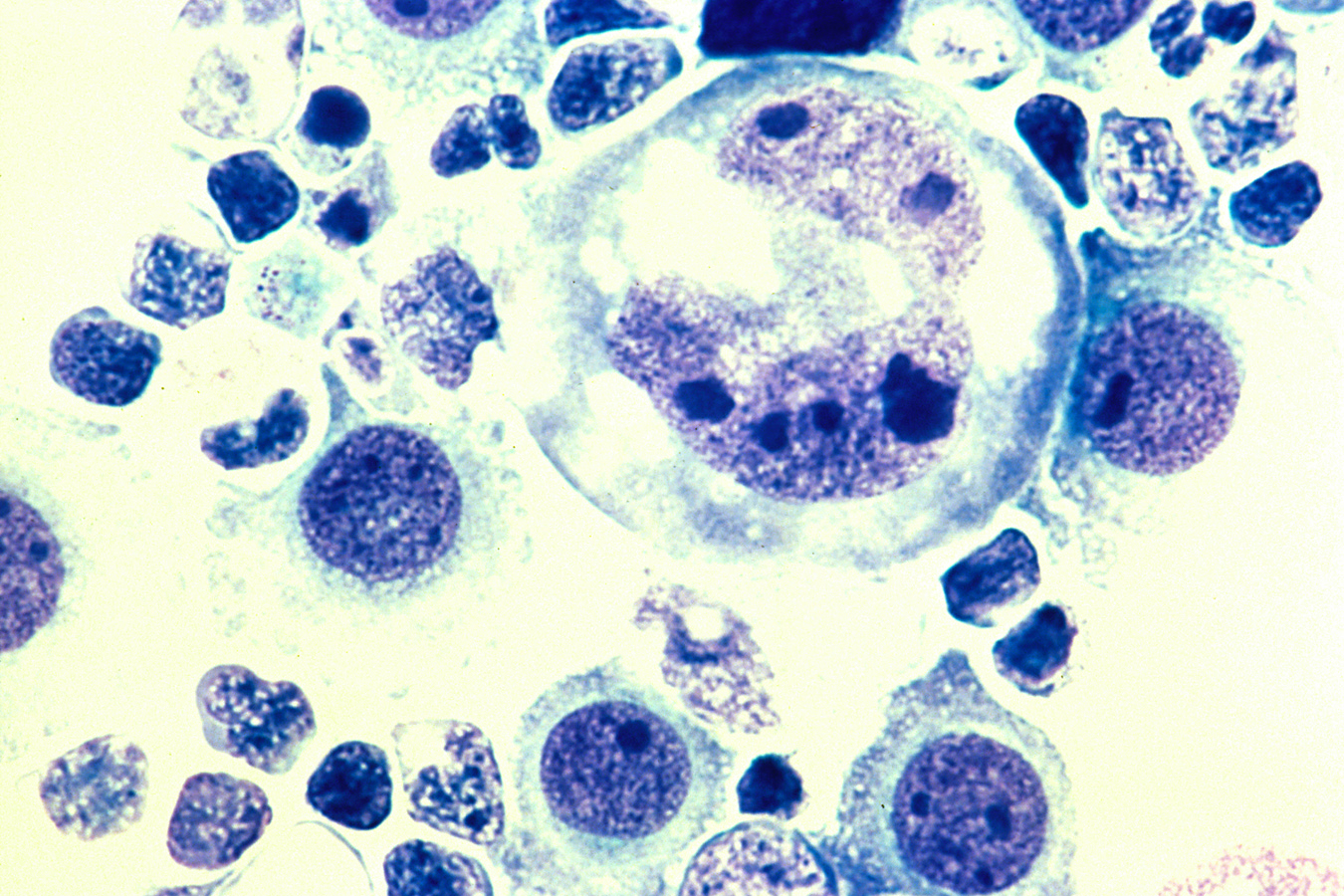

Seagen specializes in developing antibody-drug conjugates (ADCs), which utilize antibodies to target cancer cells specifically, sparing healthy tissue and potentially enhancing treatment effectiveness with reduced side effects, according to Seagen’s website.

Bourla praised ADCs as “one of the greatest technologies to battle cancer,” drawing a parallel to the success of mRNA technology, which Pfizer helped manufacture with BioNTech for Covid-19 vaccines.

mRNA technology functions as a delivery vehicle for cellular instructions, facilitating the development of antibodies against viruses like Covid-19.

“ADCs are turbo-charged guided missiles that are attacking the cancer cells and can make a huge difference,” Bourla explained.

Pfizer anticipates that acquiring Seagen will significantly bolster its oncology portfolio, adding four approved cancer therapies that collectively generated nearly $2 billion in sales in 2022.

Seagen’s leading product, Adcetris, used to treat lymph system cancers, alone brought in $839 million in sales last year, marking a 19% increase from the previous year according to Seagen’s latest earnings report.

Sales of Padcev, another Seagen treatment targeting cancers of the urinary tract, also surged 33% in 2022 to reach $451 million.

“These medicines are on a strong growth trajectory, with significant lifecycle programs anticipated to drive continued uptake and growth,” Bourla highlighted during a conference call earlier on Monday.

Pfizer projects Seagen to generate approximately $2.2 billion in revenue this year, reflecting a 12% year-over-year increase, according to a Pfizer press release.

The company anticipates that Seagen could contribute over $10 billion in risk-adjusted sales by 2030, with potential for further growth beyond that timeframe.

The acquisition aligns with Pfizer’s strategic shift as it anticipates a decrease in Covid-related sales this year following record revenues of $100 billion in 2022 driven by its Covid-19 vaccine and antiviral pill, Paxlovid.

Pfizer aims to refocus on oncology, a sector it believes will lead the industry’s growth.

Pfizer’s oncology division reported $12.1 billion in revenue last year and boasts 24 approved treatments, including the breast cancer drug Ibrance.

Pending regulatory approval, Pfizer expects to finalize the acquisition of Seagen later this year or early in 2024.

Bourla acknowledged potential antitrust scrutiny due to the deal’s magnitude but expressed confidence, stating, “We think we have a clean case.”

“While the environment is always challenging, and we’re preparing for it, I don’t foresee issues,” Bourla added.

Cancer remains a significant global health challenge, with nearly 10 million deaths attributed to the disease in 2020, as reported by the World Health Organization.

The American Cancer Society projects a substantial increase in the global burden of cancer by 2040, expecting new cases to rise to 27.5 million annually and cancer-related deaths to reach 16.3 million.

Bourla underscored during the interview that the impact of cancer extends beyond patients themselves: “If not patients, they will be affected as husband or wife, they will be affected as daughter or son.”

“With this technology in our hands, we can make a big difference,” he concluded.