The Federal Trade Commission (FTC) has filed a lawsuit against three major U.S. health companies — UnitedHealth Group’s Optum Rx, CVS Health’s Caremark, and Cigna’s Express Scripts — accusing them of inflating insulin prices. These companies, known as pharmacy benefit managers (PBMs), are intermediaries that negotiate drug prices with manufacturers and manage prescription drug benefits for insurers.

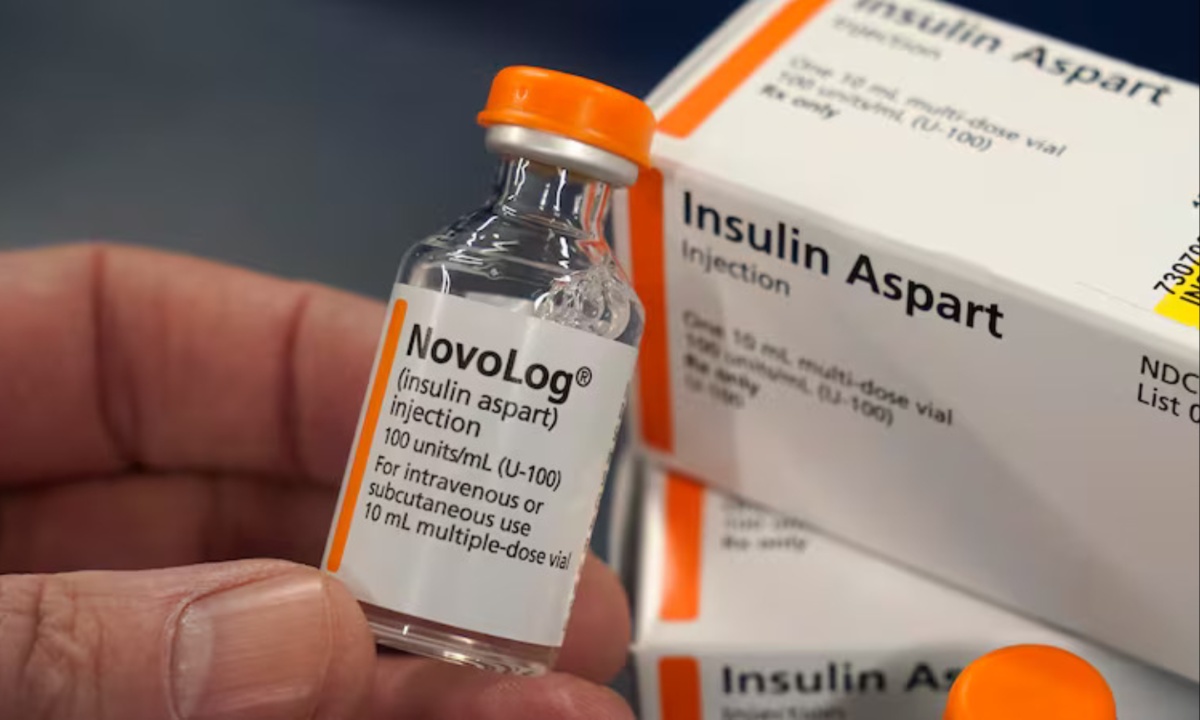

The FTC claims that PBMs use pricing strategies that increase their profits while making insulin more expensive for patients. These three PBMs manage around 80% of the country’s prescriptions. The suit also mentions the potential for future legal action against insulin manufacturers Eli Lilly, Sanofi, and Novo Nordisk for their role in raising insulin prices.

In response, the PBMs defended their practices. UnitedHealth’s spokesperson argued that the FTC misunderstands drug pricing, claiming that its PBM, Optum Rx, has successfully negotiated lower prices. CVS’s Caremark spokesperson emphasized its efforts to make insulin affordable, dismissing the FTC’s allegations.

Meanwhile, Express Scripts accused the FTC of ideologically driven and unfounded attacks, referencing a separate lawsuit the company filed earlier in the week against the FTC for a report they deemed defamatory. The FTC’s ongoing investigation into PBMs has raised concerns about the role of these companies in increasing drug costs.

The FTC alleges that the PBMs have created a “perverse” rebate system that artificially inflates insulin prices by prioritizing drugs with higher rebates, regardless of their affordability.

This, according to the FTC, leads to rising insulin prices and impacts millions of Americans who rely on the drug for survival. The lawsuit seeks to address these practices through an administrative process, aiming to end the exploitative behavior of PBMs and restore competition in the pharmaceutical market to lower drug costs overall.

The lawsuit is part of broader efforts to address high prescription drug costs, with the Biden administration and Congress focusing on increasing transparency and regulation of PBMs.

President Biden’s Inflation Reduction Act, which caps insulin costs for Medicare beneficiaries at $35 per month, highlights this focus but does not yet extend to privately insured patients. On average, Americans pay significantly higher prices for prescription drugs compared to other developed countries, further fueling the urgency for regulatory action.

Insulin manufacturers like Eli Lilly, Sanofi, and Novo Nordisk have also faced scrutiny for their role in the pricing issue. Eli Lilly, for example, significantly increased the price of its Humalog insulin over the years, but recently introduced price cuts and capped out-of-pocket costs for its insulin products.

Sanofi and Novo Nordisk have taken similar steps to reduce prices and improve affordability. However, the FTC remains concerned about the manufacturers’ involvement in the high prices, signaling that its investigation and legal actions could extend to them in the future.