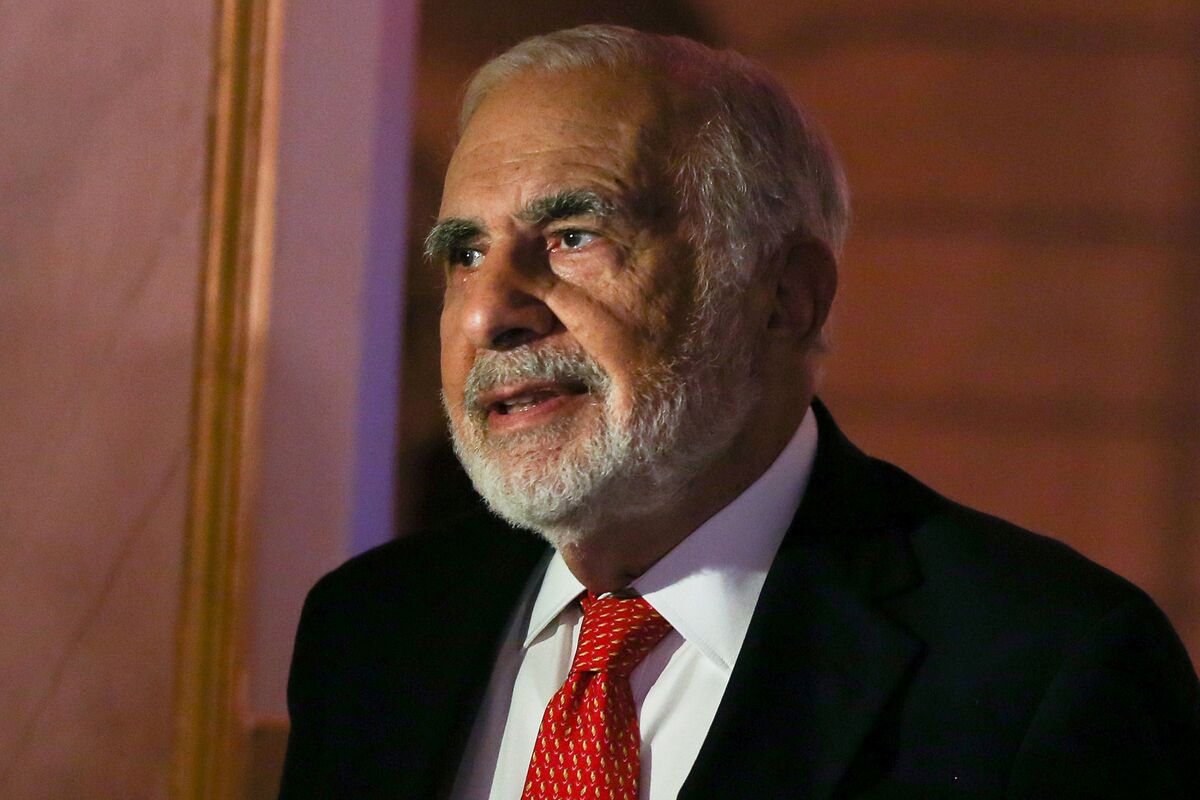

On Wednesday, Carl Icahn called for Illumina to reinstate its former CEO, Jay Flatley, “immediately,” as part of his ongoing proxy battle with the biotech firm.

In an interview with the Wall Street Journal, Icahn said that Flatley “obviously knows the company and did a good job with it.” However, he did not disclose whether he had been in contact with Flatley.

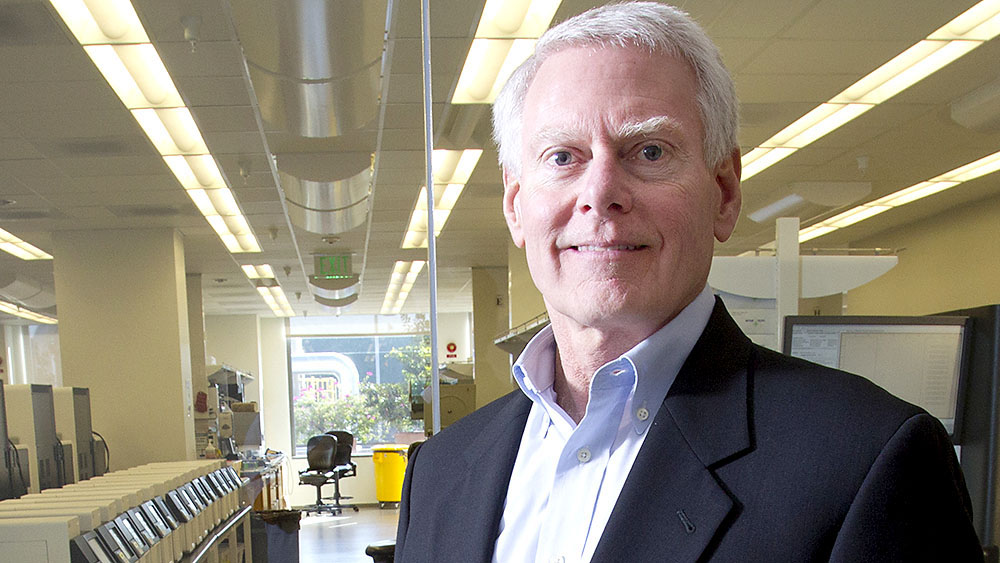

Flatley led the DNA sequencing company for 17 years until Francis deSouza took over in 2016.

Illumina, based in San Diego, credits Flatley for its significant growth, from $1.3 million in sales in 2000 to $2.2 billion in 2015. Flatley served as executive chair and later chairman of Illumina’s board until 2021.

Following Icahn’s comments, Illumina shares rose nearly 4% on Wednesday morning.

Owning a 1.4% stake in Illumina, Icahn criticized the company’s current management, particularly their decision to retain Illumina’s $7.1 billion acquisition of cancer test developer Grail in 2021.

Icahn has been advocating for Illumina to undo the “disastrous” deal, claiming it has wiped out $50 billion in the company’s market value. He stated that Illumina cannot afford to keep Grail under current macroeconomic conditions.

“They don’t have the money, and especially in this environment, they won’t be able to keep funding this money-losing business,” he said.

“I hate to say this, but this company is on a road downhill like the Eastman Kodaks of the world if they don’t get rid of Grail and focus on their core business.” Icahn referenced Eastman Kodak, a photography pioneer that went bankrupt in 2012.

“This is an urgent moment for the company and they need someone who knows what they’re doing to fix the situation,” Icahn told.

Part of Icahn’s criticism stems from Illumina’s decision to finalize the Grail acquisition without antitrust regulators’ approval.

Although Illumina overcame opposition from the U.S. Federal Trade Commission in September, it is still seeking approval from the European Commission.

The European Commission blocked Illumina’s acquisition of Grail last year, citing concerns that it would stifle innovation and reduce consumer choice.

The commission also revealed a planned order to force Illumina to undo the deal.

In the interview, Icahn proposed a rights offering as the best way to liquidate Grail, allowing Illumina shareholders to decide whether to invest in Grail.

“The best part of a rights offering is you find a way to fund Grail without adding debt to Illumina,” he told.

“It’s a way to allow Illumina shareholders to get the benefit of buying Grail at a possible bargain price or sell their rights and get a benefit in this fashion.”